Financial software, often called fintech, is a type of computer software that is designed to help businesses store and manage financial data and streamline financial processes.

For example, a business might use a tool to track and analyze its accounts receivables or streamline customer payments. And a bank might use a tool that analyzes data with AI to make better loan decisions.

The most common types of financial software are accounting and monetary transaction tools, online banking apps, insurance software, forecasting apps, payment gateways, and more.

As a salesperson, you’ll likely be selling financial software to businesses, likely financial institutions, rather than to individuals. Most personal finance software is self-signup.

In this article, we’ll help you decide if financial software sales is the right fit for you. You’ll learn what it’s like to sell into financial software, how much you’ll earn in different sales positions, some current trends in the space, and fintech companies that are often hiring people like you.

What it’s Like to Work in Financial Software Sales

As a financial software salesperson, you’ll spend most of your time attempting to open up conversations with decision-makers at businesses and guiding them through your sales process towards a close.

That means giving demos of the software, delivering presentations and materials, holding discovery calls, handling objections, managing relationships, and facilitating paperwork.

However, the main functions of your day-to-day depend on which role you hold. Business development reps will be more focused on the earlier stages of the sales process, focusing on prospecting and opening up meetings. Account Executives, on the other hand, take the deal the rest of the way to a close.

While most reps will sell software into the financial services industry — to banks, lenders, insurers, credit unions, and more — some reps might sell to other businesses that need help with their finance or accounting. They may sell a payment processing app to a startup, for example.

In the latter case, reps will typically target VPs of Finance or the Head of Accounting at the company.

But, when selling into financial services companies and banks, you’ll likely have to sell to multiple stakeholders, from the data security department to C-suite executives, each with different needs, meaning you’ll have to learn about multiple buyer personas and their motivations.

Regardless of your target person, to close a deal in financial software sales, reps have to know their financial lingo and be able to intelligently discuss a prospect’s financial systems and processes.

If they can’t do this, prospects might feel as if the seller isn’t knowledgeable enough to provide the right solution to their issues. But don’t worry, you can learn it even without industry experience.

Financial Software Sales Compensation

Fintech salespeople in the US earn an average base salary of $82,018 per year, according to ZipRecruiter.

If you add the average commission for a SaaS Account Executive, which is usually about the same as the base salary, then you’re looking at the average fintech rep earning a total of over $160,000 per year. This makes it one of the most lucrative fields in tech sales.

However, if you’re just starting out and hold an SDR or BDR position, it’s likely that you’ll earn between $70,000 and $90,000 total per year.

To get a better idea of what reps are making in this field, let’s look at some average earnings for sales reps at a few of the top financial software companies:

- Stripe: AEs make an average of $163,000 per year. Technical Account Managers make about $138,000 per year.

- NetSuite ERP: AEs earn an average of $117,602 per year, and Account Managers bring home a close $116,595.

- Gusto: Account Executives earn about$ 80,000 on average per year.

Of course, as with any sales job, the amount you earn depends on how well you sell your product and build relationships. But, there are some specific ways to succeed in financial tech sales that we’ll share next.

How to Succeed in Financial Tech Sales

There are some strategies you can use to ensure you crush quota as a financial software salesperson:

- Teach Leads About Your Brand: It can be difficult to convince leads to purchase fintech if they’re unfamiliar with the brand and solution. Unfortunately, most fintech companies have poor brand recognition at the moment, so as the seller, you’ll have to share brand content and interact with buyers on social media to familarize them.

- Become a Specialist: Banks and financial firms only really make a purchase if they’re sure it will work. Competition is too high to risk a failed venture. To win their trust, learn a lot about your software, your ideal customer, and these companies face.

- Sell Smaller Solutions First: To get your foot in the door, try selling your less expensive and complex software solution first. Then, when they enjoy the results, you can start to cross-sell and upsell.

Furthermore, if you keep up to date on new finance tactics and practices, you’ll be better equipped to sell your software to finance professionals. That leads us to our next section.

Trends in Finance

In any tech sales job, it’s crucial to keep a finger on the pulse of the industry so that you can demonstrate your knowledge and expertise to your prospects, whose trust your commission depends on.

Specifically, here are some tech trends in the financial services industry:

- Artificial Intelligence Adoption: The financial services industry has been quick to accept and integrate AI into their tech stack in order to automate repetitive tasks and safeguard against human error that can lead to massive financial losses.

- Mobile Banking Takes Off: Banks, insurers, and other financial services companeis are eager to give their customers the most convenient experience possible and are therefore deploying mobile apps equipped with chatbots and personalized communication.

- Work-From-Home is Being Accepted: Though hesitant, the financial services industry is becoming open to WFH arrangements, meaning they’ll need work-from-anywhere solutions and software to do things like help their analysts get the high computing capacity they need.

We recommend reading up on any industry you’re thinking about entering or selling into, for the process itself will tell you if this is an interesting field for you or if you’ll become bored and restless after the honeymoon phase has worn off.

3 of the Best Financial Software Companies with Sales Teams

If after learning about the job and industry trends you feel like financial software might be for you, read on. Below are some financial software companies that are often hiring salespeople and pay well.

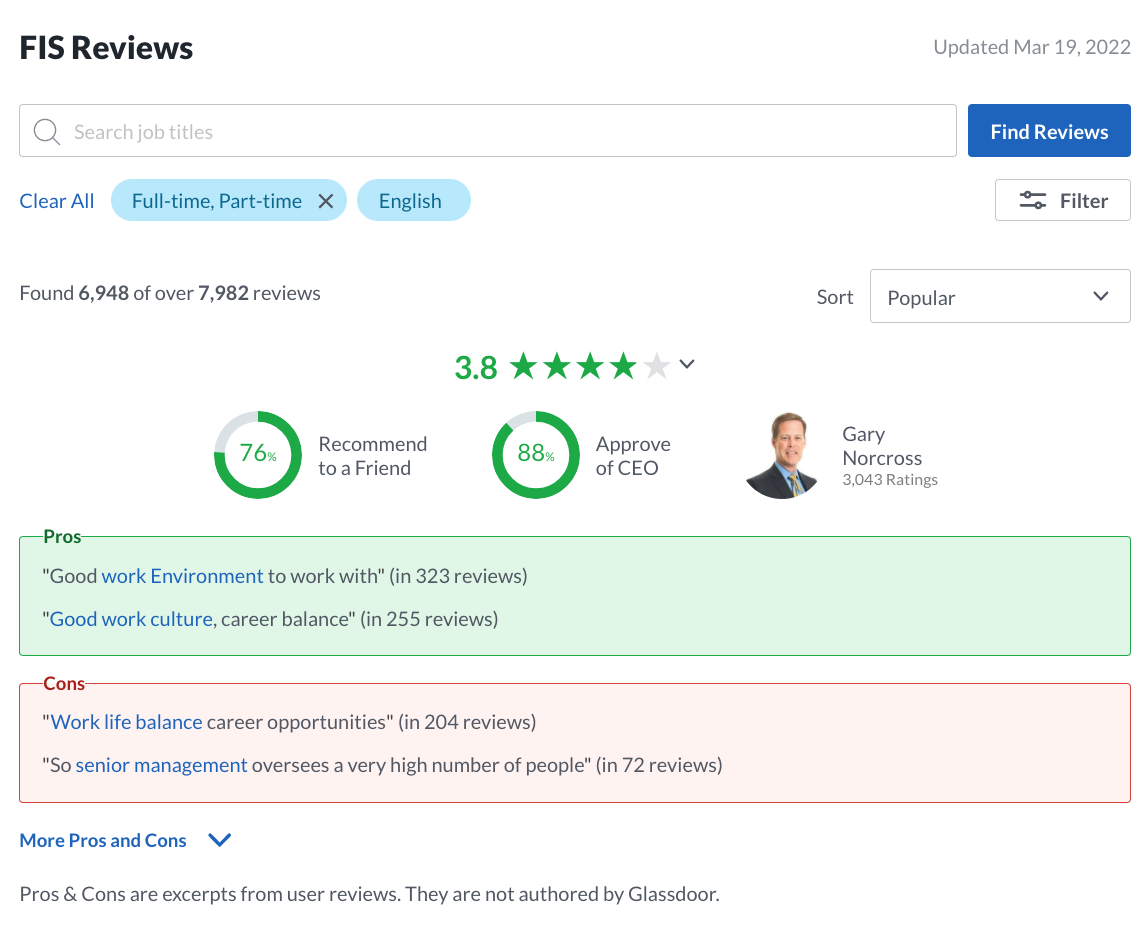

FIS Global

FIS Global is a huge financial services technology company with over 10,000 employees and a wide variety of solutions, which help with retail and institutional banking, payments, asset management, risk, and more. The average Account Executive at FIS Global earns $110,720 per year. About $82,000 of that is salary and the rest is commission.

It’s also a good place to work, with 76% of 8,000 previous and current employees saying they’d recommend working there to a friend.

Image via Glassdoor

Finastra

Finastra is a financial software company that offers a portfolio of solutions to retail banking, transaction banking, and treasury capital markets. Their Account Executives’ average pay is about $111,000 per year, with a $70,000 base salary. If you value strong leadership, this might be the spot for you since their CEO has an employee approval rating of 90%.

Image via Glassdoor

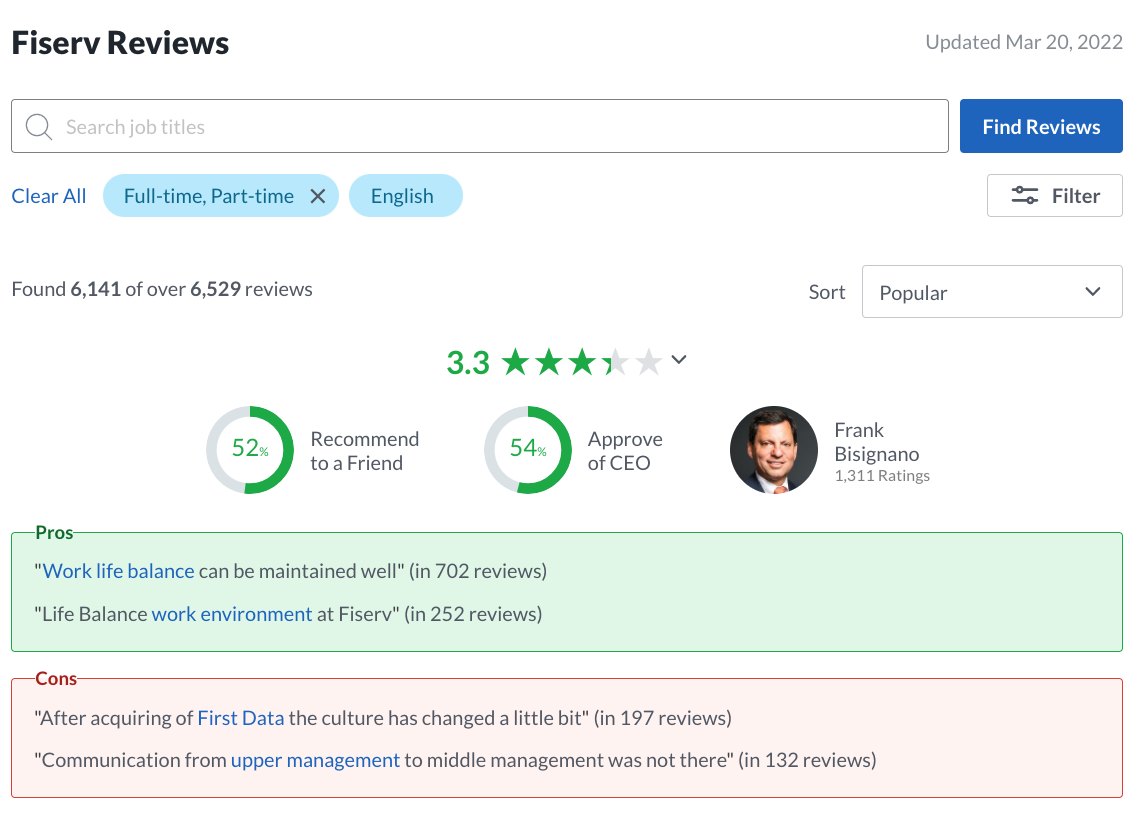

Fiserv

Fiserv sells financial software to banks, thrifts, credit unions, security broker-dealers, finance and leasing companies, and retail companies. An Account Executive there can expect to earn around $128,000 in compensation per year. Meanwhile, their Sales Directors average over $200,000 per year.

Only about 52% of current or former employees would recommend working there to a friend. Although, many reviewers named work/life balance as a benefit of working there.

Image via Glassdoor

Is Financial Software Sales Right for You?

If you have a strong interest in finance and technology, then this may be the right career path for you. After working as a financial software salesperson, you could even easily make a switch into the financial services industry if you find it fascinating. Or you can continue climbing the latter in sales, bringing in more and more money with each position you attain.

To find financial software sales jobs, check out the Salestrax job board.